Let’s take a look at each region to see what data is emerging and then check that evidence against our core beliefs.

- Concerns about China clearly are the number one issue facing investors worldwide. The general consensus is that the Chinese economy is in worse shape today than generally thought, which, the view goes, is the reason for the recent devaluation to stimulate exports and to stem capital outflows.

As I mentioned last week, the Chinese political and monetary authorities are acting in the same manner as our Fed, BOJ and ECB did by increasing the money supply, devaluing their currencies to stimulate exports and lowering interest rates. Give China a break and anticipate positive change from these moves as we did elsewhere.

It was just announced that the People’s Bank of China would significantly add to the country’s banking system with new liquidity to boost lending by cutting the deposits banks are required to hold in reserves and lowering interest rates. Clearly, a plus longer term.

An interesting stat is that the Chinese Yuan has appreciated 56% against its trading partners and 33%, inflation adjusted, against the dollar since 2005. Both the IMF and I applaud the move to a more flexible currency to reflect market conditions than be fixed.Clearly it will take time for all the measures introduced by the Chinese government to take hold. China continues to transition to more domestic growth from an emphasis on exports. The government takes a long-term view of things recognizing that change does not happen overnight. So do we. Be patient!

- The Fed minutes came out from the July 28-29th meeting and showed the Fed concerned by continuing low inflation and problems overseas, specifically China. It added that low commodity prices, due in large part to a slowdown in China, would keep downward pressure on inflation going forward. The minutes stated, “many officials continue to see downside risks arising from economic and financial developments abroad though the risks to the domestic outlook were nearly balanced.”

Bottom line is that fears of a September rate increase evaporated. I found it interesting that the Fed staff members lowered their forecasts for economic growth and inflation for the remainder of the year and 2016.

The U.S economy is doing just fine: housing starts climbed to a six year high; builder confidence is at a 10 year high and consumer prices rose 0.1% from the prior month and up 1.8% year over year excluding food and energy. What deflation?! By the way, exports to China are less than 1% of GNP.

- Growth in the ECB was moderate in the second quarter at around 0.3%. However the August PMI rose to 54.1 from 53.9 in the prior month indicating continued economic expansion albeit slow. Forecasts for the year were slightly reduced to 1.4% from a previous estimate of 1.5%. The yuan devaluation and the recovery in the Euro last week hit the European bourses hard and bond rallied to multi-month highs.

Greek Prime Minister Tsipras called for an early election in September in an attempt to strengthen his position and weaken the dissenters. The Greek deal is done but can the country live up to the terms remains my question.

- Emerging market concerns was the real culprit in my opinion for the weak financial markets last week. Fears of competitive devaluations swept through the markets after Kazakhstan’s currency fell 22% in one day after being devalued. Who would be next? Add to that the added tension between North and South Korea and it is easy to understand a flight to safety. But not all countries or risks are alike. Risks exist in Brazil, Turkey Venezuela and Russia for sure.

Could there be contagion? If so, I don’t think the impact would really hurt the Unites States and Europe much at all. Watch emerging market debt for signs of added stress in the system.

- Oil prices broke beneath $40 per barrel on Friday only to settle slightly above that level. Let me repeat that this is a supply problem as demand is increasing. In addition weak economic data out of China has pressured prices, as China is the second largest consumer of oil in the world.

As prices break beneath cash costs, some producers have to sustain production to generate cash to service its debts, which only increases the problem. We need more bankruptcies to occur and production to be shut down to bring supply and demand into balance.

Let me repeat that lower energy prices are a huge positive for the global economies as it reduces inflation and raises disposable personal income. If lower energy prices were caused by a drop in demand that is one thing but if it caused by an increase in supply that is something else. Demand is growing and so are the global economies, albeit slowly.

Now that we have looked at the major issues bothering the markets last week, let’s look at our core beliefs to see if we need to adjust.

- Monetary policy remains easy virtually everywhere and the supply of funds exceed the demand for funds, which is favorable for financial assets. Now that China is easing further and the Fed is on hold, this belief is even further substantiated.

- The dollar will remain the currency of choice, which may impede growth but will lower inflationary expectations. I expect a brief counter-trend rally in the euro and yen as the U.S yield curve flattens out. But longer term the dollar will remain strong, which is a huge positive. Think of the Swiss Franc.

- The yield curve steepening has been postponed by further economic weakness overseas, lower than expected inflationary pressures, and a weakness in demand for funds. A steepening yield curve is good for financials so a change in view necessitated a reduction in financials in the portfolio. Yields will remain surprising low, which will help boost stock market multiples. The risk premium for stocks will benefit from reduced financial risk and a reduced demand for funds due to a conservative bias.

- A new conservatism permeates governments, corporations and individuals. I believe it is the reason that economic growth has failed to recover as fast as many economists thought. Consumers have saved most of the energy savings and corporations are limiting capital spending to depreciation.

- Profits will surprise on the upside, which occurred in the second quarter. Overall U.S corporate profits are still growing but are being held down by poor energy and commodity profits and a strong dollar. Corporations continue to generate free cash and are reducing debt, increasing their dividends and buying in stock. Buffett approves!

- M&A activity will remain strong. No doubt as buyers and sellers are both winners! New high reached in M&A this year. More to come.

- A Greek default will be contained. A new deal was reached kicking the can down the road for another year or two.

- The Fed cannot begin raising rates until 2016. Could happen in December depending on continued growth here and an improvement overseas. Delayed for now.

- The economic cycle will be extended with lower highs and higher lows. This belief is even more valid today than ever before.

- Speculation exists today in real estate, private equity and art. Still a valid belief.Conclusion?

My core beliefs remain intact.

If ever there was a time to review all the facts, step back and reflect on them, pause once more and then do in-depth research, it’s now.

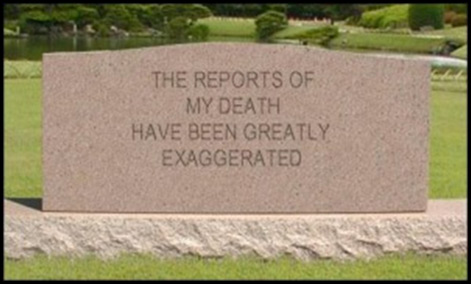

You need patience as change occurs over time. Investing is a marathon, not a sprint. My aim is to double the value of my portfolio every 5 years with this approach. So far, I’m on track.