Overview

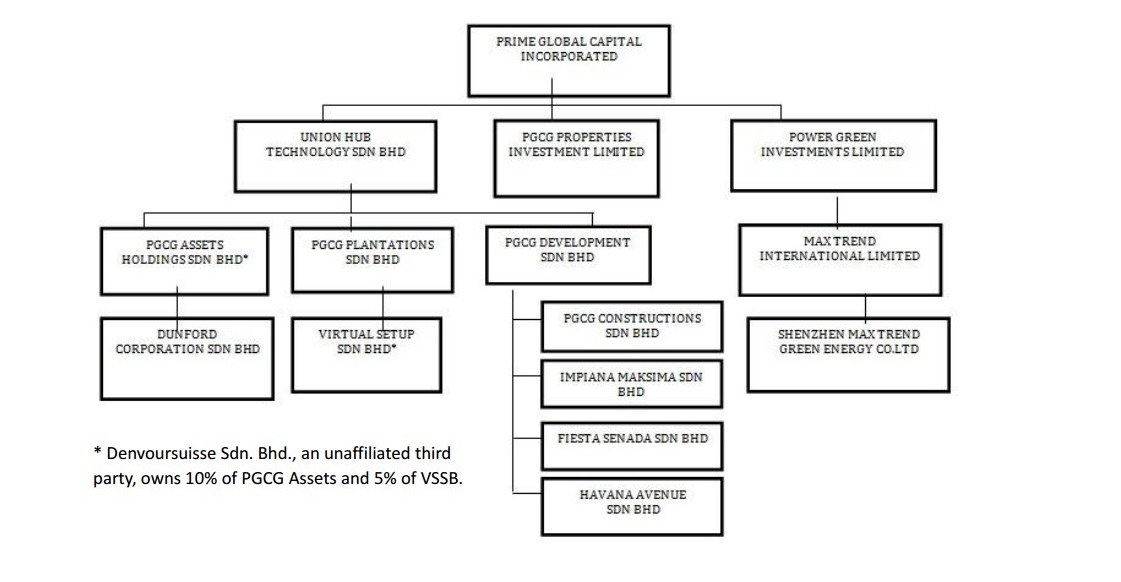

Prime Global Capital Group Incorporated, through its subsidiaries, engages principally in the real estate and plantation businesses in Malaysia. Since its inception in 2004, Prime Global Capital Group has experienced substantial growth to transform into a multinational corporation with business interests across the region. Our rapid expansion has led us to be listed on the OTC QB under the trading symbol–“PGCG”.

Prime Global Capital Group Incorporated, through its subsidiaries, engages principally in the real estate and plantation businesses in Malaysia. Since its inception in 2004, Prime Global Capital Group has experienced substantial growth to transform into a multinational corporation with business interests across the region. Our rapid expansion has led us to be listed on the OTC QB under the trading symbol–“PGCG”.

Fueled by the opportunities of globalization, our company has embraced a diversification strategy which has led us to invest in several countries. We are becoming a visionary player in the local property development industry while dynamically developing palm oil and durian plantations. Our investments have a positive impact on the daily lives of many people and they generate substantial returns for our company.

In view of the global economic recovery, we have great confidence that the value of properties will appreciate around the world. Consequently, we are embarking on a diversification strategy that involves the acquisition of quality properties, especially in the United States and Malaysia. Our globalization and diversification plans are based on our stable foundation. We are certain that our dynamic endeavors which span over Europe, Africa, the United States and Asia will take our organization to even greater heights of success.

Prime Global Capital Group’s industry leading management team, extensive operational experience, resources and management system will help ensure that our projects in operation deliver a continuous flow of revenue to the company. Moreover, we are and remain devoted to upholding the following vision and mission components we adopted at the Company inception:Strengthen Scope and Expand Perpetually

In order to maintain our competitive advantage, we will expand the business by prudently select development

projects that have the market opportunity and economic impact to create a more stable and flexible revenue

stream for the Company and our investors.

Remain Committed to Sustainable Development

We will remain committed to sustainable development and as such, we will setup a complete and consistent product and service value chain for developed industries. From plantations to properties, we must, alongside our partners and customers, adhere to the principle of sustainable development.

Maintain Balance

We will maintain a balanced business and investment combination, that includes different industries. We will invest simultaneously in developing and developed countries, and will explore new projects to strengthen the company’s scope. At same time, we plan to recruit skilled specialists and industry leaders, to help maintain balance and decrease risk.

Property Management

Prime Global Capital Group acquires, develops, constructs, manages, operates, and sells commercial and residential real estate properties located in Malaysia, primarily in Kuala Lumpur and Selangor. PGCG is also involved in the cultivation and distribution of palm oil processors, refineries and Palm oil products. The company is based in Kuala Lumpur, Malaysia.(Previously “Menara CMY”)

Jalan Ampang, 50450 Kuala Lumpur.

Type: Hotel

Floors: 15

Land Area: 23,013 sf

Built-up: 2,000- 5,000 sf

Total Lettable Area: 85,350 sf

Rental: RM550,000/month

(approx US$169,492/month)

Contract Start: August 2014

– Covered parking

– Uncovered parking

– 24-hour security

– Centralized AC

– Underfloor trunking system

– Broadband Internet

– 3 high-speed lifts

Megan Avenue 1

(Previously “Megan Phileo Promenade”)

189, Persiaran Hampshire, Off Jalan Tun Razak,

50400 Kuala Lumpur

DETAILS

Type: Commercial Office

Floors: 12

Built-up: From 1,518 – 4,900 sf per unit

Total Lettable Area: 58,800 sf

Rental: From RM608 psf

Annual Gross Rent Income Est: $180,000 (based on full occupancy 12 months at current market rates)

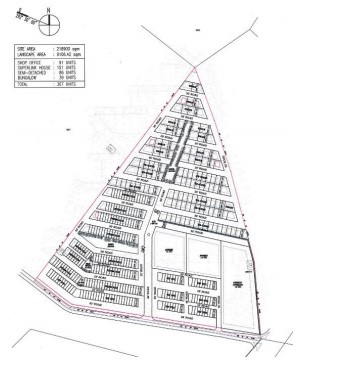

Property Development

– Location: 54.1 acres sprawled over 1,163 acres of prime land within Bandar Puncak Alam.

– Greening Rate: 50%

– Est. Size: 10x the size of Subang Jaya

– Est. Population: 500,000 people.

– Est. Gross Development Value: RM 511,3510 million

– Status: Entered into MOU in July 2016 Yong Tai Berhad and PGCG Assets Holdings Sdn Bhd, a wholly own subsidiary of PGCG Inc to develop 1,039 units of mixed development properties

DETAILS

– Freehold status

– Greening rate: 45%

– Est. Gross Development Value: RM 858,000,000 (upon completion)

– Status: Development order from the state has been obtained

Plantation

GROWTH PLANS

‐ Considering building or acquiring one or more oil mills to extract and sell CPO and PKO from FFB cultivated on our own plantation and on smaller local plantations.

‐ Replant 70 acres currently with premium durian trees for an aggregate of 130 acres of premium durian.

‐ Plantation cultivates and distributes FFBs to palm oil processors located in Kuala Lampur, Malaysia that extract, refine and resell palm oil. Byproducts of the refinery process are sold to other manufacturers further downstream to produce various derivative products.

‐ Began planting premium durian, of the “Musang King” variety, in the first quarter of 2014, and have replanted 60 acres of our palm oil with premium durian trees.

‐ Premium durian trees require approximately 5 years to mature and produce grade A fruit. No revenue expected from durian until 2019.

Dato’ Wong Weng Kung, CEO and Director – Joined in 2010. In 2004, he founded one of the first m-commerce companies in Malaysia, Mobile Wallet Sdn. Bhd. (MWSB)

Teh Liong Tat, CFO and Director – Joined in 2010. Brings more 27 years of professional accounting and financial experience. Previous to our company, he was the Financial Controller at MW Group.

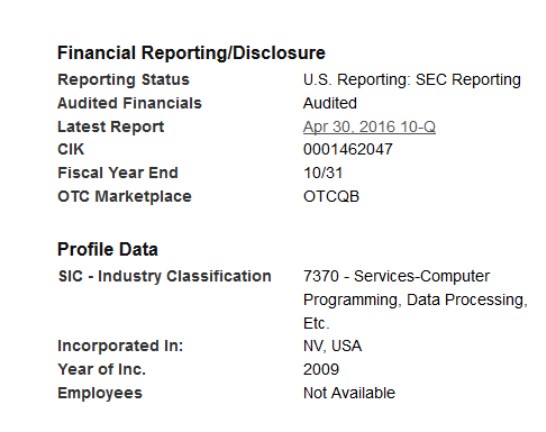

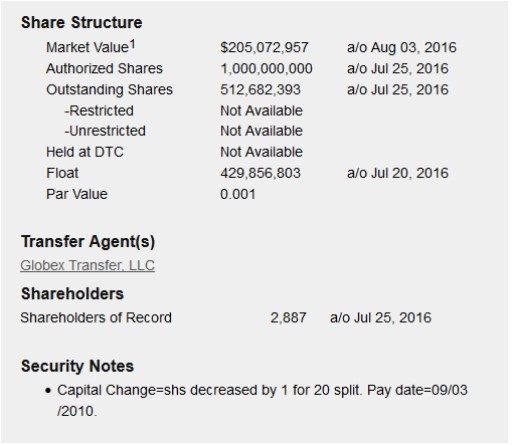

INVESTOR INFORMATION

Securities and Regulatory Information